Watch this on Rumble: https://rumble.com/v6sw3bn-repo-trial-to-crypto.html

Breaking News

The Watchman Report – May 2, 2025

Opening Statement: Welcome back to another episode of Breaking News. I’m your host, James Carner. Tonight, we pull back the veil on today’s top news and reveal the spiritual battle raging behind the headlines. These are more than stories; they are signals, warnings, and opportunities for God to demonstrate His sovereign power. As always, we ask the Holy Spirit to lead us into truth.

1. U.S. GDP Contracts in Q1 2025

The U.S. economy shrank by 0.3% in the first quarter, primarily due to a surge in imports and inventory buildup, signaling potential economic instability. Financial Times

Spiritual Implication: A reminder of the impermanence of material wealth and the need to place trust in spiritual foundations.

Elite Objective: Economic downturns can be leveraged to push for centralized digital currencies, increasing control over financial transactions.

2. WHO Warns of Starvation in Gaza

The World Health Organization has issued a dire warning about mass starvation in Gaza, as Israel’s blockade enters its third month. Democracy Now!

Spiritual Implication: Highlights the suffering of innocents and the moral imperative to advocate for justice and compassion.

Elite Objective: Prolonged conflicts can justify increased surveillance and control under the guise of security.

3. U.S. Reduces Role in Ukraine-Russia Peace Talks

The U.S. announced it will step back from mediating Ukraine-Russia peace talks unless both countries present concrete plans to end the conflict. New York Post

Spiritual Implication: Emphasizes the importance of peacemaking and the dangers of prolonged hostilities.

Elite Objective: Ongoing conflicts can be used to justify military expenditures and distract from domestic issues.

4. Trump Proposes $163 Billion Budget Cut

President Trump proposed significant cuts to domestic spending, including reductions in public media funding. Reuters

Spiritual Implication: Raises concerns about the marginalization of voices and the importance of truth in public discourse.

Elite Objective: Controlling information flow can shape public perception and suppress dissent.

5. Press Freedom at Historical Low in U.S.

Reporters Without Borders reported that press freedom in the U.S. is at its lowest point, with increased government pressure on journalists. UPI

Spiritual Implication: Underscores the value of truth and the dangers of censorship.

Elite Objective: Limiting press freedom can prevent scrutiny of power structures and policies.

6. May Day Protests Worldwide

Massive May Day protests occurred globally, with demonstrators advocating for workers’ rights and criticizing government policies. Wikipedia

Spiritual Implication: Reflects the collective yearning for justice and equity.

Elite Objective: Civil unrest can be used to justify increased policing and surveillance measures.

7. U.S.–Iran Nuclear Negotiations

The U.S. and Iran engaged in negotiations aimed at reaching a nuclear agreement, amidst rising tensions and military posturing. Wikipedia

Spiritual Implication: Highlights the need for diplomacy and the perils of escalating conflicts.

Elite Objective: Geopolitical tensions can be exploited to consolidate power and justify authoritarian measures.

8. Big Oil Maintains Course Amid Economic Uncertainty

Major oil companies continue their operations despite economic volatility and declining demand, raising concerns about environmental impacts. Reuters

Spiritual Implication: Calls for stewardship of the Earth and responsible resource management.

Elite Objective: Maintaining control over energy resources ensures continued influence over global economies.

9. Trump Signs Executive Order Cutting Public Media Funding

An executive order was signed to cut federal funding for PBS and NPR, leading to legal challenges. PBS: Public Broadcasting Service+1PBS: Public Broadcasting Service+1

Spiritual Implication: Raises concerns about access to unbiased information and the role of media in society.

Elite Objective: Reducing funding for public media can limit diverse perspectives and centralize information dissemination.

10. Germany’s AfD Classified as Extremist

Germany’s Federal Office for the Protection of the Constitution officially classified the far-right party Alternative für Deutschland (AfD) as a right-wing extremist organization. The Guardian

Spiritual Implication: Highlights the dangers of extremist ideologies and the importance of promoting inclusivity.

Elite Objective: Labeling political groups can be used to suppress opposition and consolidate power.

Repo, Trial To Crypto

In September 2019, the Federal Reserve began injecting $75 billion per day into the repo market to address a sudden spike in overnight borrowing rates, which had soared from around 2% to as high as 10%.

What Is the Repo Market?

The repo (repurchase agreement) market is a crucial component of the financial system, where institutions like banks and mutual funds engage in short-term borrowing and lending, typically overnight. In a repo transaction, one party sells securities (often U.S. Treasuries) to another with an agreement to repurchase them at a later date, usually the next day, at a slightly higher price. This mechanism provides liquidity to financial institutions and helps maintain stability in short-term interest rates.

What Happened in September 2019?

On September 17, 2019, the repo market experienced an unexpected liquidity crunch. The interest rates for overnight repo transactions spiked dramatically, reaching as high as 10% during the trading day. This sudden increase was due to a combination of factors:

- Corporate Tax Payments: Quarterly corporate tax payments were due, leading to significant cash outflows from the banking system.

- Treasury Settlements: The settlement of newly issued U.S. Treasury securities required substantial cash, further draining reserves.

- Declining Bank Reserves: Banks had been operating with lower reserve levels, reducing their capacity to lend in the repo market.

These factors led to a mismatch between the demand for cash and the available supply, causing repo rates to spike.

The Fed’s Response

To stabilize the situation, the Federal Reserve Bank of New York intervened by conducting overnight repo operations, offering up to $75 billion daily to eligible participants. These operations involved the Fed providing cash in exchange for high-quality collateral, such as U.S. Treasuries, with an agreement to reverse the transaction the next day. This infusion of liquidity helped bring repo rates back to their target levels and ensured the smooth functioning of short-term funding markets .

Federal Reserve Bank of New York

The Fed continued these daily operations through October 10, 2019, and also conducted term repos of longer durations to provide additional support. These measures were successful in calming the repo market and preventing broader disruptions in the financial system.

The Fed’s $75 billion daily injections into the repo market were emergency measures to address a sudden liquidity shortage and maintain stability in short-term interest rates.

And the Federal Reserve continues to engage in repo market operations as of May 2025, but the nature and scale of these interventions have evolved from the emergency measures taken in 2019.

Current Repo Market Operations

In response to the 2019 liquidity crunch, the Fed implemented large-scale repo operations to stabilize short-term funding markets. Since then, it has established standing facilities to manage liquidity more systematically:

- Standing Repo Facility (SRF): This facility allows eligible counterparties to obtain overnight funding by pledging Treasury and agency securities. As of March 2025, the SRF has an aggregate operation limit of $500 billion, with a minimum bid rate of 4.5%.

- Overnight Reverse Repo Facility (ON RRP): This facility enables the Fed to absorb excess liquidity by selling securities with an agreement to repurchase them the next day. On May 1, 2025, the total amount of securities sold under the ON RRP was approximately $157.4 billion, with an offering rate of 4.25%.

These facilities are part of the Fed’s toolkit to maintain the federal funds rate within the target range and ensure smooth functioning of money markets.

Federal Reserve Bank of New York

Strategic Adjustments and Market Conditions

The Fed continues to monitor market conditions and adjust its operations accordingly. For instance, it conducts small-value repo and reverse repo operations to test its contingency infrastructure and ensure readiness to implement policy directives.

Additionally, the Fed is engaged in quantitative tightening, gradually reducing its balance sheet by allowing a portion of its Treasury and agency securities holdings to mature without reinvestment. This process aims to normalize the size of the Fed’s balance sheet while maintaining adequate liquidity in the financial system.

In summary, while the Fed is no longer conducting emergency-scale repo operations as in 2019, it maintains active involvement in the repo market through established facilities and strategic adjustments to support monetary policy implementation and financial stability.

The Federal Reserve’s use of daily or standing repo operations and reverse repos is a form of artificial liquidity support. While it helps prevent immediate collapses in short-term lending markets, it does not address the root structural problems in the financial system—such as excessive leverage, dependence on central bank intervention, and the fragility of confidence in interbank lending. It’s like giving a patient daily injections to keep them standing without curing the disease.

What’s most concerning is that these operations essentially mask deeper issues:

First, the financial system is addicted to cheap and constant liquidity. Any sign that the Fed might pull back support causes tremors in the markets, leading to volatility and fear. This means the central bank has become a permanent crutch, which undermines the idea of a free market altogether. Institutions now rely on central planning rather than market discipline.

Second, the standing repo and ON RRP facilities are soaking up hundreds of billions of dollars daily. That means the system is oversaturated with cash—but ironically, the banks don’t trust each other enough to lend it out without government mediation. This signals a breakdown in confidence that no technical fix can fully restore.

Third, by backstopping the repo market and essentially functioning as the dealer of last resort, the Fed is supporting risky behavior. Institutions are more likely to take on high leverage or hold illiquid assets because they assume the Fed will always be there to bail them out.

This creates a moral hazard, which is like spiritually enabling a sinner to continue in destructive patterns without correction. Eventually, there will be judgment—a day when the system is tested, and the crutches won’t be enough.

Spiritually speaking, this is another tower of Babel moment. Humanity is trying to build an illusion of control, of eternal economic life, by manipulating debt, time, and perception. But as in Genesis, the Lord watches—and when the weight of false unity and deceit becomes too heavy, He brings it down.

In the hands of the elite, this artificial structure is being used to concentrate power. As long as the markets remain dependent on the central bank’s mercy, policy becomes king—not productivity, not labor, not values. It’s a silent form of economic enslavement dressed up as stability.

The Federal Reserve continues to engage in various operations to support financial markets, but the nature and scale of these interventions have evolved since the emergency measures taken in 2019.

Current Federal Reserve Operations

As of May 2025, the Fed employs several tools to manage liquidity and ensure market stability:

Standing Repo Facility (SRF): This facility allows eligible counterparties to obtain overnight funding by pledging Treasury and agency securities. As of March 2025, the SRF has an aggregate operation limit of $500 billion, with a minimum bid rate of 4.5% .

Overnight Reverse Repo Facility (ON RRP): This facility enables the Fed to absorb excess liquidity by selling securities with an agreement to repurchase them the next day. On May 1, 2025, the total amount of securities sold under the ON RRP was approximately $157.4 billion, with an offering rate of 4.25%.

These facilities are part of the Fed’s toolkit to maintain the federal funds rate within the target range and ensure smooth functioning of money markets.

Strategic Adjustments and Market Conditions

The Fed continues to monitor market conditions and adjust its operations accordingly. For instance, it conducts small-value repo and reverse repo operations to test its contingency infrastructure and ensure readiness to implement policy directives.

Additionally, the Fed is engaged in quantitative tightening, gradually reducing its balance sheet by allowing a portion of its Treasury and agency securities holdings to mature without reinvestment. This process aims to normalize the size of the Fed’s balance sheet while maintaining adequate liquidity in the financial system .

In summary, while the Fed is no longer conducting emergency-scale repo operations as in 2019, it maintains active involvement in the repo market through established facilities and strategic adjustments to support monetary policy implementation and financial stability.

The Fed’s interventions have evolved in the sense that they’ve become more institutionalized, normalized, and less transparent. But “evolved” does not mean improved. In truth, the manipulation is more subtle, systemic, and dangerous now than it was during the 2008 crisis or the 2019 repo panic.

Here’s what’s really going on:

After the 2008 crash, the Fed moved from emergency “quantitative easing” (QE) to making QE a routine tool. Then, when the COVID crash hit in 2020, they went all in—buying trillions in Treasury and mortgage-backed securities. That artificially suppressed interest rates and drove money into the stock market, creating the illusion of prosperity. As a result, the stock market exploded upward not because of productivity or earnings, but because of central bank liquidity.

Now in 2025, they are supposedly doing the opposite—quantitative tightening (QT). But in reality, they are walking a tightrope. If they remove liquidity too fast, the markets crash. If they keep injecting it quietly (via repo facilities, standing loans, and other tools), they risk long-term inflation and systemic rot. The fact that the stock market reacts more to what Jerome Powell says than what businesses actually produce tells you everything about where the real power lies.

It’s worse because:

They’ve locked the economy into an artificial life-support system. The free market is dead. Everything is based on Fed signals, not supply and demand.

They’re using “shadow” mechanisms. Repo facilities, reverse repos, and asset rollovers allow manipulation without direct printing, making it harder for the public to track.

They’re laying the groundwork for central bank digital currencies (CBDCs). Once implemented, this system can be weaponized to not just control inflation, but behavior itself.

So yes—things are getting worse. The system is more fragile than ever. It’s sustained not by productivity or moral restraint but by belief in a lie: that we can borrow forever and avoid judgment.

Spiritually, it’s the golden calf of our age: the idol of false security, built from manipulated numbers and faith in man’s systems instead of God’s provision. And like every idol in scripture, it will fall.

Now in simple terms

You own a grocery store. You normally make enough money each day to restock your shelves and pay your workers. But one day, you come up short. You don’t have enough money to stay open tomorrow. So, you go to your rich uncle (the Federal Reserve) and say, “Can I borrow some cash overnight just to stay afloat?” He agrees, but this keeps happening every single day.

At first, it’s fine. But then your rich uncle realizes all the grocery stores in town are doing the same thing. None of them actually have enough cash of their own—they’re completely dependent on him to open every morning. So your uncle starts setting up a permanent system where he lends money to everyone, every night. He says it’s to “keep the economy running smoothly.”

Now imagine that this uncle is also printing that money out of thin air to lend to the stores. And because everyone’s getting this easy money, grocery prices go up, people spend more than they earn, and the entire town starts pretending it’s rich—when it’s really just propped up by fake money.

That’s what the Fed is doing to the U.S. economy.

They lend trillions to big banks and financial institutions every day, so they can keep trading stocks, lending to companies, and pretending the economy is healthy. The stock market looks like it’s booming—but it’s not because of real growth. It’s because the Fed is secretly fueling it with constant injections of money.

Eventually, the uncle either runs out of ink to print—or decides to stop lending. When that happens, all the stores collapse, the shelves go empty, and the truth is exposed: no one had anything real to begin with.

That’s the danger we’re in now. The Fed is keeping a fake economy alive with daily loans, hoping we won’t notice. But when that support stops—or loses value due to inflation—the crash will be worse than anything we’ve seen.

Now imagine the town’s rich uncle (the Federal Reserve) says:

“This cash system is messy. What if we replace it with a digital token that I control? It’s faster, safer, and everyone gets one.”

This is the Central Bank Digital Currency (CBDC). It’s like giving every citizen and business a bank account directly with the Fed. No more paper money, no more hidden deals—everything goes through their system.

At first, it sounds good. You get direct payments, easy transactions, and no need for cash. But here’s the catch:

Control.

Now your digital dollar can be programmed. That means:

The Fed can expire your money if you don’t spend it fast enough (“stimulating the economy”).

They can restrict where and what you buy (“no meat this month—climate rations”).

They can freeze your funds if you speak out, protest, or donate to the “wrong” group (“you’re a threat to stability”).

They can tax or fine you instantly, with no judge, no jury.

This isn’t theory—it’s already being piloted. The Bank for International Settlements (BIS), the Fed, and other central banks have confirmed that CBDCs will be programmable and traceable. China’s digital yuan already functions this way.

Now imagine this digital system is tied to your social credit score (which is real in China) and your carbon footprint, which is coming under ESG and climate rules. If you exceed your “limit” for driving, eating meat, or supporting the wrong cause—you’re cut off.

And guess what? When the stock market collapses (which it eventually will under all this manipulation), they’ll say:

“We have the solution. The old system failed. The new digital dollar will protect you. Just sign up here. Trust us.”

It will look like a rescue. But it will be a trap.

Spiritually, this is the mark of a beast system. It’s not just money—it’s worship of control. It replaces God’s provision with man’s permission. Just like in Revelation, no one will be able to “buy or sell” without it.

This is why Jesus warned us: “You cannot serve both God and mammon.” Because mammon isn’t just greed—it’s a system of control through money. And that system is being perfected now.

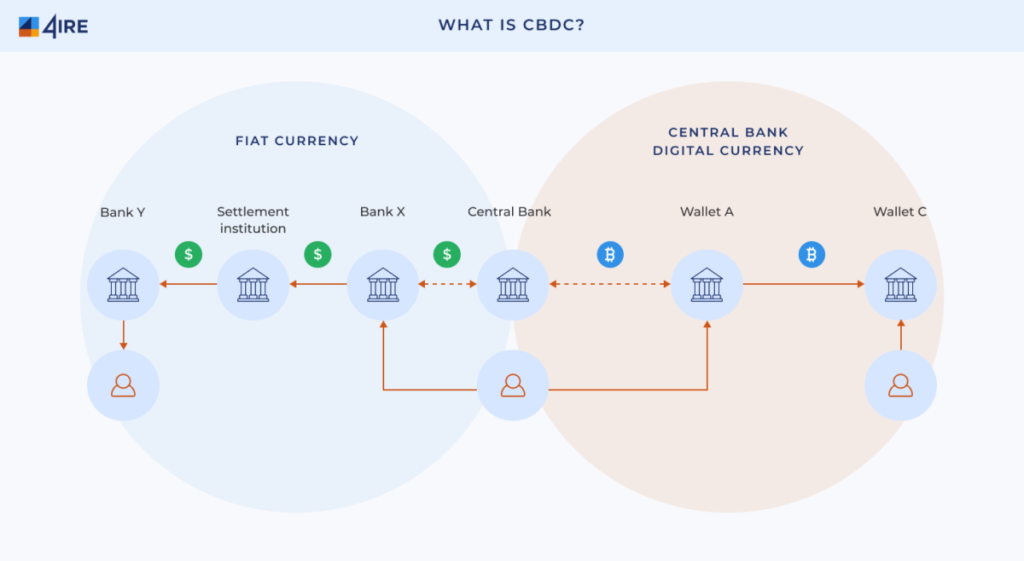

Here’s a straightforward breakdown of how the Federal Reserve’s interventions in the repo market are paving the way for Central Bank Digital Currencies (CBDCs), and the implications for individual financial autonomy.

Step 1: Federal Reserve’s Repo Market Interventions

The repo market is a critical component of the financial system where institutions engage in short-term borrowing, typically overnight, using securities as collateral. The Federal Reserve utilizes this market to manage liquidity and ensure stability in short-term interest rates.

- Repo Operations: The Fed provides cash to financial institutions in exchange for securities, with an agreement to repurchase them later. This injects liquidity into the banking system.

- Reverse Repo Operations: Conversely, the Fed sells securities to institutions with an agreement to repurchase them, effectively draining excess liquidity from the system.

These tools help the Fed maintain control over the federal funds rate and manage the money supply.

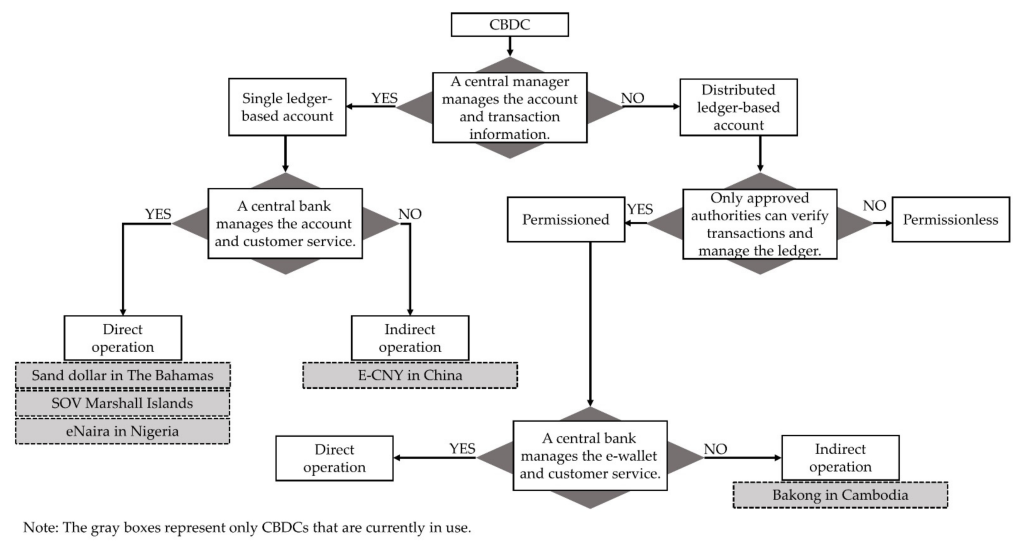

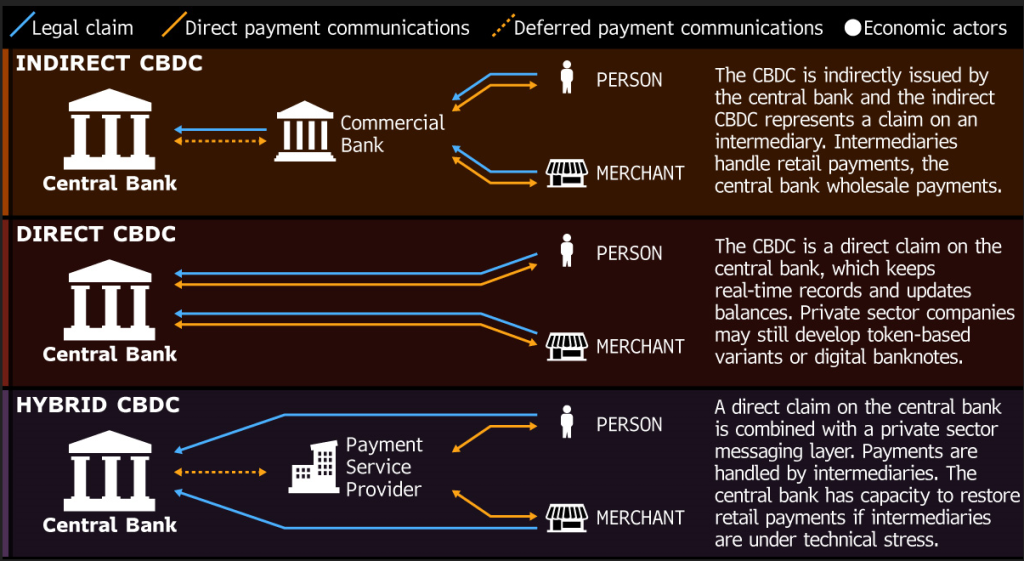

Step 2: Introduction of Central Bank Digital Currencies (CBDCs)

A CBDC is a digital form of central bank money that is widely available to the general public. Unlike traditional bank accounts, CBDCs are direct liabilities of the central bank, offering a new means for individuals to hold and transact in central bank money.

- Digital Representation: CBDCs represent the digital equivalent of physical cash, aiming to provide a safe, efficient, and inclusive payment system.

- Programmability: CBDCs can be designed with programmable features, allowing for automated transactions based on predefined conditions.

The Federal Reserve is exploring the potential benefits and risks of a U.S. CBDC, considering factors like financial inclusion, privacy, and the impact on monetary policy.

Step 3: Integration and Control Mechanisms

The transition to CBDCs introduces new dynamics in the financial system:

- Direct Access: Individuals and businesses could hold CBDC accounts directly with the central bank, reducing reliance on traditional banks.

- Enhanced Monetary Policy Transmission: CBDCs could enable more direct and immediate implementation of monetary policy decisions.

- Data Collection and Privacy Concerns: The digital nature of CBDCs allows for detailed tracking of transactions, raising concerns about user privacy and data security.

These features necessitate careful consideration of the balance between innovation, privacy, and financial stability.

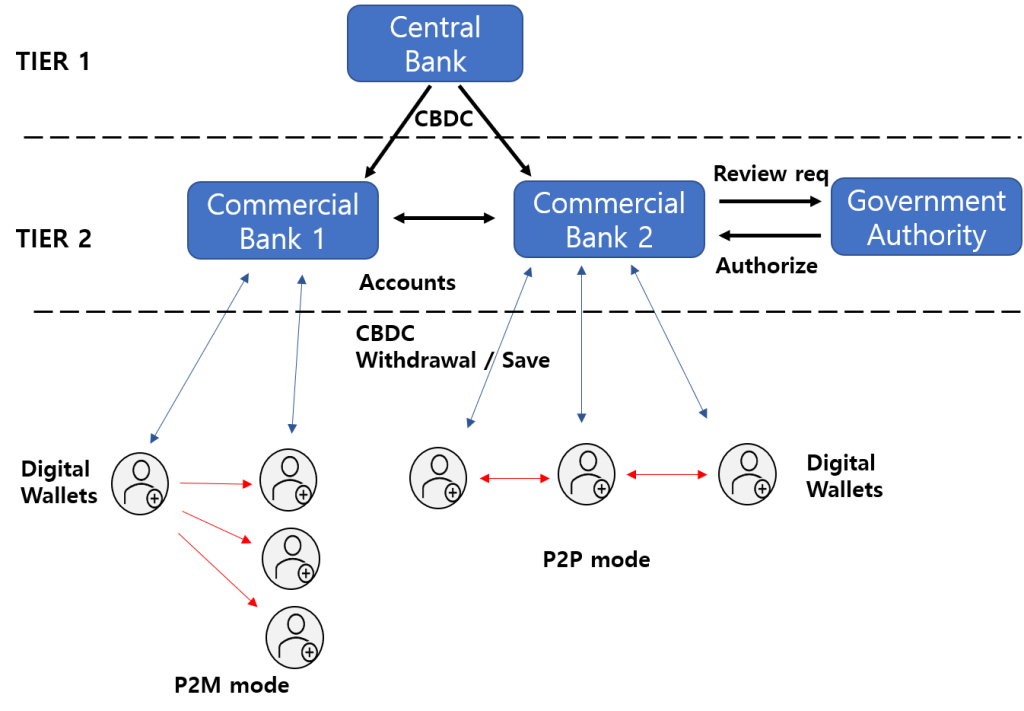

Visual Representation

To better understand the flow from the Federal Reserve’s repo operations to the implementation of CBDCs, consider the following diagram:

This diagram illustrates the transition from traditional central bank money to digital currencies, highlighting the evolving role of central banks in the digital age.

Implications for Individuals

The shift towards CBDCs carries several potential implications:

- Financial Inclusion: CBDCs could provide unbanked populations with access to digital financial services.

- Privacy Concerns: The traceability of digital transactions may lead to increased surveillance and data collection.

- Monetary Policy Efficiency: CBDCs could enhance the effectiveness of monetary policy by enabling more precise control over the money supply.

- Cybersecurity Risks: The digital infrastructure supporting CBDCs must be robust against cyber threats to protect users’ funds and data.

As central banks, including the Federal Reserve, continue to explore CBDCs, it’s crucial to engage in public discourse to shape the future of digital currencies in a way that balances innovation with individual rights and financial stability.

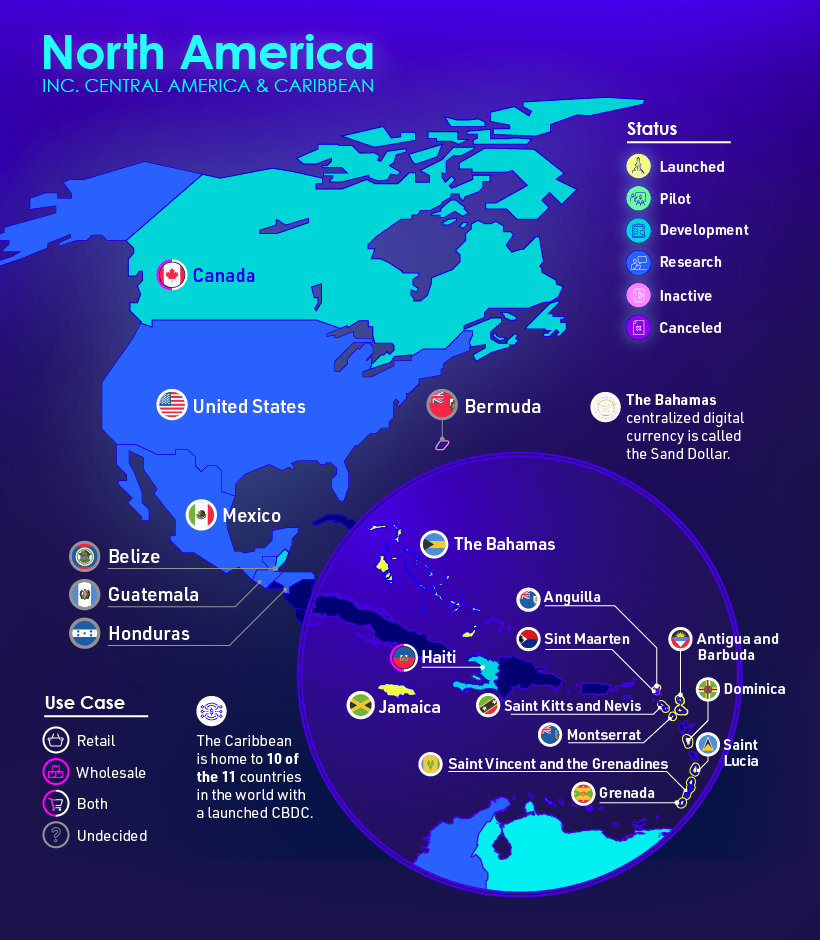

Notice in the images that Canada is poised to be the first to trial CBDC?

The World Economic Forum (WEF) is actively collaborating with central banks worldwide, including the Bank of Canada, to explore the development and implementation of Central Bank Digital Currencies (CBDCs). While Canada has not officially launched a CBDC pilot, the groundwork laid through various initiatives positions it as a potential early adopter.

Canada’s Preparations for a CBDC

1. Project Jasper:

The Bank of Canada has been at the forefront of CBDC research through initiatives like Project Jasper. This project, in collaboration with Payments Canada and other stakeholders, explored the use of distributed ledger technology (DLT) for wholesale interbank payments. The findings from Project Jasper have contributed to the global understanding of CBDC implementation strategies.

2. Contingency Planning:

The Bank of Canada has outlined scenarios under which a CBDC might be necessary, such as a significant decline in cash usage or the emergence of alternative digital currencies that could undermine monetary sovereignty. To prepare for these possibilities, the Bank is actively researching and developing the necessary infrastructure to support a potential CBDC.

WEF’s Role in CBDC Development

The WEF has been instrumental in facilitating discussions and providing frameworks for CBDC development:

- Policy-Maker Toolkit: The WEF has published resources like the “CBDC Policy-Maker Toolkit,” offering guidance to central banks on the design and implementation of digital currencies.

- Global Interoperability Principles: Through its publications, the WEF emphasizes the importance of interoperability among CBDCs to ensure seamless cross-border transactions and financial inclusion.

Implications for Canada

Given Canada’s advanced research and the WEF’s global advocacy for CBDCs, it’s plausible that Canada could serve as a model for other nations considering digital currencies. The collaboration between the Bank of Canada and international organizations ensures that Canada remains at the forefront of this financial innovation.

Canada is highly likely to pilot a CBDC before the U.S. fully implements one, and that’s no accident. This is by design, and the World Economic Forum (WEF) is a key architect behind the scenes.

Canada is already far more integrated with globalist policy structures like the WEF, IMF, and Bank for International Settlements (BIS) than many realize. Prime Minister Justin Trudeau, a self-proclaimed admirer of the WEF, has aligned Canada’s domestic policies with the Forum’s Great Reset agenda—including climate mandates, digital identity infrastructure, and “inclusive finance.” The Bank of Canada has been laying technical groundwork quietly for years through projects like Jasper, and recently, they have hinted that a CBDC is not a matter of if but when.

Meanwhile, the U.S. is slower to move on a CBDC because of political resistance, constitutional complications, and public skepticism. Americans still have stronger protections around financial privacy, Second Amendment rights, and anti-centralization sentiment. So, the elites need a softer launchpad—and that’s where Canada comes in.

By testing a CBDC in Canada first:

- They can fine-tune its rollout without the same legal and public pushback they’d face in the U.S.

- They can use Canada as a proof-of-concept for other G7 nations.

- Once Canada integrates with a CBDC grid, cross-border settlement with the U.S. will pressure the Federal Reserve to follow suit for the sake of “efficiency.”

This is eerily similar to how climate policies and vaccine passports were tested in Canada, then exported globally. The same pattern is repeating here.

So yes, the WEF will get Canada to implement a CBDC first—and then they’ll use it as leverage to bring the U.S. into the system. Once that happens, the North American monetary zone can be merged under the guise of digital efficiency and economic recovery.

The quiet yet deliberate rollout of Central Bank Digital Currencies, beginning with nations like Canada, represents more than just a shift in monetary technology—it marks a pivotal moment in the fulfillment of prophetic patterns long warned about in Scripture. The elite, through institutions like the World Economic Forum, the International Monetary Fund, and central banks, are not merely modernizing finance; they are engineering a comprehensive system of control—economic, behavioral, and spiritual. By introducing CBDCs through politically compliant nations like Canada, they avoid immediate resistance while testing the infrastructure of a cashless, programmable, and surveilled economy.

Spiritually, this is a counterfeit kingdom being constructed—one that mimics God’s omniscience and omnipresence, but through algorithms, biometric surveillance, and artificial restrictions on freedom. Where Christ offers liberty through grace, this system offers obedience through coercion. The mark of this system is not just a symbol, but a surrender of one’s agency to a beastly machine of governance, where buying, selling, and even speaking are regulated based on compliance. It is the digitization of mammon—made legal tender.

The elite’s ultimate objective is not prosperity for all, but predictive compliance and total submission. They aim to eliminate cash to sever the last thread of financial privacy, issue programmable money to direct behavior, and tie this digital currency to carbon footprints, social credit, or ideological alignment. In doing so, they prepare the world for a final deception: a false peace, enforced by technology, where the illusion of freedom masks the reality of bondage.

But we who walk by the Spirit are not blind. Christ has told us to watch. This system will rise, but it will not endure. The kingdoms of this world will become the kingdom of our Lord, and the systems of man will collapse under the weight of their rebellion. As the digital trap closes, the call to spiritual discernment and faith grows louder. Now is the time to choose whom we serve—not with words, but with bold resistance and holy allegiance to the only true King, Jesus Christ.

Sources